Inside: These eleven money lessons are the things I wish I’d learned in school or at home, what we’re teaching our kids so they can hopefully experience financial freedom far sooner than we will.

The numbers stared at me from the paper they handed me: a three figure monthly payment.

That much A MONTH?!

I was sitting in the required student loan meeting six months before college graduation.

That’s the one where they sit you down and tell you exactly what signing that little sheet of paper three years ago will actually mean for your everyday adult life after college.

No one told me before that day. And if they did, I swear I don’t remember being told.

I knew theoretically that it was going to take ten years to pay those loans back, but, but, that amount? For TEN YEARS?!

All those late night Ben & Jerry’s and Panda Express meals on dining points, plus two degrees with no job guarantees, well, it didn’t exactly seem worth it.

Welp, too late now. I was $45,000 in the red.

The papers in my hands seemed to mock my panic, saying, “Welcome to adulthood. Good luck!”

You Might Also Like: Unpopular Opinion? Birthdays for Kids Should Be SIMPLE (Not $500 Affairs)

11 Money Lessons Kids Need for a Brighter Financial Future

This post probably contains affiliate links, which means I may earn a commission if you make a purchase through those links. As an Amazon Associate, I earn from qualifying purchases. You can find our full disclosure HERE.

If you ask on social media what adults wish they’d learned in school, finances will always come up: over and over and over again.

Budgeting. Investing. Taxes (especially taxes).

My parents taught me about budgeting and frugal living, and I’m so grateful to them for that.

But the education system as a whole – from kindergarten to higher education – is failing kids, especially by still pushing degrees with a $100,000 (or more!) price tag, claiming they’re essential for success.

High school offers a little financial education maybe, but when it’s removed from real life, does it really stick?

I started my adult life $45,000 in the negative. My husband graduated the year after we got married and doubled that figure (that wasn’t even all of it!).

Digging ourselves out of that hole took years.

But thankfully, I picked up a wealth of financial education along the way, things school didn’t teach me, wisdom I’m now passing on to our kids.

Even if schools did step up to teach these things, I’m not sold on their perspective: the financial norm leaves a LOT to be desired.

So in no particular order, here are the money lessons for kids I believe are most important for financial security and ultimately, financial freedom.

You Might Also Like: Conventional Parenting Advice You Don’t Need to Follow (Unless You Want To)

1. Unless you plan on going into a handful of specialized fields, college is not a necessity, and by extension, neither are student loans.

We aren’t pushing college: it’s an option, not THE option.

In my opinion, it will be the next big industry to crash, just like the housing market in 2008. People will no longer be able to justify $160,000 degrees that don’t guarantee you a job.

And no one is sitting kids down to say: that career you want to pursue with that $$$ degree? It doesn’t pay enough to make $700 a month of student loan payments worth it (see #3).

Does college offer ways to expand your thinking and be more open to new ideas and people? Yes.

Are there less expensive ways to achieve those things? Yes.

Ways that don’t involve starting your adult life with bankrupt-exempt debt? Also, yes.

If our kids want to go, we’ll make a plan to help them get there. But it will be a partnership kind of thing, with a clear “why” behind it.

Plus, there are so many ways to “hack” college and get the same degree for a fraction of the cost. Just say no to student loans, which I’ll emphasize again are bankrupt-exempt.

Starting adulthood in often massive debt for some random degree is crippling the next generation financially. I said what I said.

Helpful Resource for Career Success Without College: The Degree Free Podcast

2. Make a pretend budget for your desired career in your dream city before you commit.

I’m not sure where I heard this tip originally, but I love it!

You take the average starting salary in your child’s potential career and use it to make a basic budget. Don’t forget to take out taxes and health insurance premiums, first.

Find the average rent in the city they want to live in. Add in average grocery costs, utilities, etc.

Once all the essentials are budgeted, they can see what’s leftover. Can we say: reality check? Plus, they learn about budgeting, all in one fell swoop.

I’ll never forget a friend telling me about his own far-too-late reality check halfway through grad school.

A financial counselor sat him down to let him know that his estimated salary after leaving college would simply not be enough to support the debt load required to finish the degree.

Would he be able to get more loans? Sure. But he would be living paycheck to paycheck (or worse) for the rest of his life.

This was the first time he had even considered this, the first time anyone had mentioned it to him. If only more parents and admissions officers and financial counselors were this honest.

The college system seems predatory to me in this way, just like the housing market before the 2008 crash. That 18-year-olds can sign for loans over $40,000, loans that they can never be free of? It’s insane.

Shortly after that conversation, my friend quit grad school to pursue a career that would actually pay the bills.

3. Frugal living will only get you so far: channeling that money-saving energy into increasing your income will get you much farther financially.

I spent so many years pouring energy into clipping coupons and saving money on groceries.

I would scrape off $50, $100 even from our grocery budget. And then I’d pat myself on the back for my couponing prowess.

But I was working so hard for HOURS to save $100 when I could have been working to create hundreds of dollars, instead.

Thankfully, I discovered making money online. The internet has changed everything: it has truly leveled the playing field in the world of work (and in education, too).

Now instead of couponing and meal planning around grocery deals to save $25 a week, I’m using that same amount of time to make thousands of dollars, instead. I wish I’d known this earlier!

Related: How to Create a Minimalist Meal Plan to Save Time and Your Sanity

4. You pay for physical possessions with more than money. You pay with your time, your space and your mental health.

I’m fresh off what feels my hundredth Wall-E viewing, and more than ever before, I am unapologetic about being a minimalist.

I have no qualms about preaching its benefits to my kids, either.

Not only is our consumeristic culture killing the planet our children’s children will inherit, it’s killing us. Studies show that clutter causes anxiety and stress, particularly for women.

Whatever stuff you buy needs to be maintained, and it takes up space. You also have to clean it – or move it in order to clean around/underneath it.

Not only that, but that money once spent is gone forever, not going to work for you earning more money.

Minimalism also seems to take care of the “living within your means” piece naturally. My kids struggle to come up with something to buy with birthday money or more than 1-2 ideas for Christmas gifts.

Related: The 7 Best Books on Minimalism & Simple Living (I’ve Read 90% of Them)

5. Living at home past age 21 can be a great way to get ahead financially (and you’re welcome to do so, for super cheap rent, of course).

Our culture has this weird idea that if your child hasn’t moved out by 22, their growth is stunted in some way.

But what if that idea is hurting them – and entire generations – financially?

With the current financial climate the way it is, I honestly don’t see how the next generation will get ahead any other way.

They could live at home and save for a down payment on a house or max out their retirement accounts to reach financial independence earlier.

We need to stop the narrative that living at home as an adult is a bad thing. Charge very low rent to cover costs, $200-300 a month (you don’t want them to get too comfy), agree on shared household labor and let them get ahead in life.

To make this work, respectful parenting is a necessity! What young adult wants to live with controlling, authoritarian parents?

Related: 5 Respectful Parenting Books I Wish I’d Read Sooner

6. Cars are not assets: they’re tools to get from point A to point B. Buy a used car in cash.

Car payments are one of the biggest drains on your finances. And it turns out, over 85% of Americans have a one! Yikes!

New cars are definitely not worth it: they drop 30-40% in value within a year.

We have been driving used, relatively old cars for years. They can be safe, reliable, and save you a TON of money.

Our current vehicle is a 2005 Toyota Sienna, which we bought used only when we had to seven years ago. It has 175k miles, and our mechanic thinks we can definitely get another 100K before the van dies.

Now we pay ourselves a car payment every month into a savings account for when we will need another car a few years down the road.

But let me tell you: our kids will be driving “Old Faithful” as I jokingly call her, and we will encourage them to save up and buy a cheap, used car that passes a trusted mechanic’s inspection.

(P.S. You can have a license when you can pay for car insurance.)

Related: We Happily Bought a 14-Year-Old Car With Cash – Here’s Why

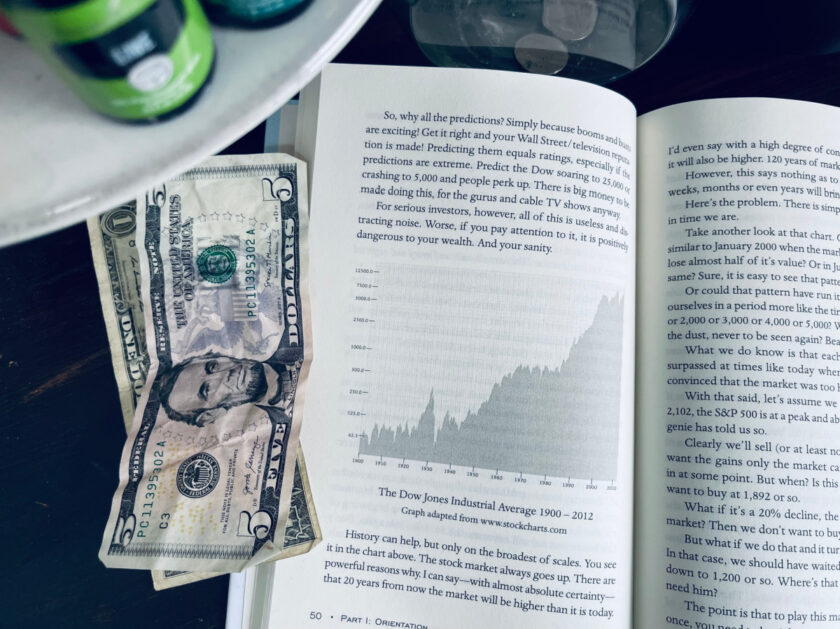

7. Compound interest + time = magic: start a rothIRA before you turn 18, if possible.

If you’ve ever seen those charts showing investing $10,000 in index funds at age 22 v. $10,000 at 32, you know that compound interest can be amazing…but time is the most important ingredient.

We teach our kids about simple investing in the stock market index funds, using THIS book as a guide.

My 13-year-old is already interested, and we’re using an Acorns family plan to help her invest, matching her dollar for dollar. When she has enough money and a job, we will help her open a rothIRA with Vanguard, putting the money into VTSAX, a low cost index fund.

With rothIRAs, you put in money that’s already been taxed, but the money can then grow tax-free for years.

Who knows? Maybe our kids will truly take my investment advice to heart and achieve financial independence far earlier than we do. I hope so!

(8a: kids, you don’t need a financial advisor. Keep your hard-earned money, and follow The Simple Path to Wealth, instead.)

8. Credit cards are not evil: they offer so many amazing benefits, if you can use them responsibly.

“Credit cards are evil” is where Dave Ramsey lost me. Right after he said to only put 15% of your income into retirement.

Credit cards offer SO many advantages to those who can use them responsibly.

Advantage #1: they can offer fantastic rewards and cash back.

I’ve clothed my kids (and myself) for years using credit card rewards. It was one of the main ways we scraped by when we lived paycheck to paycheck.

Advantage #2: fighting fraudulent charges is so much easier!

Having battled a few fraudulent charges this summer that involved my debit card, something I rarely use, I will never again use my debit card for anything except getting cash from the bank.

When your debit card is stolen, that’s your cash GONE overnight, and banks are very reluctant to give you that money back.

Credit card companies are much more likely to side with you and return your money quickly.

The bottom line message: if you can use them responsibly and pay off the balance in full each month, take advantage of the free money.

(Also, you can add your kids as authorized users to your account without even giving them a card. Start building strong credit early.)

9. You don’t need to work full-time always, as long as you can support your present self and your future self.

I’m more than done with the typical American path sold by our culture, starting with the school system:

Go to school, go to college (rack up some debt), get married, buy a house (more debt), have kids (without financial support), work 50 years, and retire when your health is iffy, at best.

You don’t need to work full-time from 18 on, right up until traditional retirement age.

You could skip college, save up and travel the world, using our home as a base.

You could work full-time for ten years and invest until you achieve financial independence, then figure out what you want to do with the rest of the your life.

You could build an online business where you work 15 hours a week and earn more than a full-time income, doing what you want with the rest of the time.

You could love your traditional, full-time job, but still pursue financial independence and take mini-retirements along the way.

Basically, forget the “normal” cultural blueprint for a successful life. Figure out what brings you joy and define success for yourself.

As long as you can support yourself (and your family) and your future self, go out and live your best life. You only get one, after all.

10. You only get taxed more on the portion of your income in the next tax bracket: making more money is always a good thing! (Oh, and tax refunds aren’t.)

If I can point to the biggest misunderstanding I had about money besides “student loans are a good thing”, this is it.

I misunderstood tax law for so long, and it had me thinking making more money was a bad thing. And I honestly think a good portion of Americans share this misunderstanding.

If you increase you income and move into the next tax bracket, only the portion of your income that is in that bracket will be taxed at the higher percentage.

Is it always advantageous to reduce your taxable income in all the ways? Absolutely.

- Contribute as much as possible to your 401k.

- Take advantage of an HSA or FSA.

But at the end of the day, making more money is a GOOD thing.

Will the government take a slightly bigger cut? Yes. But ultimately, you’re left with more than what you started with. So don’t be afraid of increasing your income!

Also, getting a refund isn’t a good thing. It means you’ve been giving the government more of your income over the past year than you should have, and they’ve been benefitting.

Consult a professional about how you can reduce your withholdings so you pay as close as possible to what you actually owe. That money could be sitting in an interest-earning savings account, instead!

11. Financial independence is worth pursuing.

I alluded to this in point #7, but learning about financial independence absolutely blew my mind.

I had no idea that it was possible to invest enough money that it would generate income forever, enabling you to live on a fraction of it and still not run out of money.

And if you start early, you can get there faster.

Or you can contribute a portion at a young age and wait for it to grow to financial freedom age without needing to put anything else in investments (sometimes called “flamingo FIRE”).

The FIRE movement is about having the freedom to work on your terms and be able to walk away when/if you want to. Investments can give you that freedom.

I’ve talked to my kids ad nauseam about investing and financial independence, showing them our slow, but steady progress on this journey.

Give your kids copies of Playing with FIRE and The Simple Path to Wealth.

If they can avoid early debt like student loans and car payments, hopefully they will choose to invest a portion of their earnings early on, helping them get to financial independence faster.

But What About All The Other Money Lessons Kids Need?

I vaguely covered budgeting and saving, but there’s no mention of emergency funds or meal planning or “savings buckets” or negotiating bills or setting up automatic payments or even generosity.

Or so many other little money tips.

All of those ideas are great ways to hack your finances, but to me, they aren’t the most important lessons.

I believe that the eleven lessons I shared will naturally lead to these additional tips/hacks, whether kids get them directly from their parents over time or the authors of the books I offer them.

If they get the big lessons, the smaller money hacks will follow.

Let’s raise a generation of money-savvy kids who challenge the current cultural narratives and help them achieve their own versions of success.

What money lessons for kids do you think are most important? Share in the comments!

Read Next: 24 Benefits of Homeschooling Your Kids (from a reluctant homeschooler)

Great article. Which credit cards to u recommend for best rewards for clothes points etc? I’m just trying to use best one for groceries then get rewards for clothes etc.

Great article and agree with a lot. I rap love living within your means and minimalism are natural. I’m on a budget and try to live off a low set budget. What credit cards are the best for rewards? Any that you recommend?

Hey there! Nice article. I completely agree on what you written, I also firmly believe that kids need to be multi skilled for future and not depend on one profession to earn their income, this way it gives them more independent and not live the conventional way.

Although we can debate on how good college for them is, let’s say they chose to get a degree at a college and I would like to fund them at least 50%. In that scenario, I have few questions and wanted to hear your thoughts on that. I am saving for my kid’s college fund ( 6 years old) and I have a new born (1 month old), me thinking should I start another 529 fund for second one? Also, how will the world shape in next 18-20 years? Will college degrees even exist? Am I wasting my savings here?

Hi Kaushik! A few thoughts: we are very behind on retirement savings, just really starting in the last year or two to put a good chunk away. And when it comes to retirement, there really aren’t great options to cover costs if you didn’t save, as opposed to figuring out how to cover college, there are a lot of options, and theoretically, parents would be in their earning prime, able to help or work a little extra to cover costs.

We didn’t have the money to save for college before now. Now that we are catching up, we are prioritizing our retirement compared to saving for college.

A 529 also locks that money into college or other traditional education, and I’d like to keep any savings more flexible, as I have a feeling some of our kids will forgo full-time college, perhaps doing certificates or vocational programs or community college (hopefully during high school, when it’s heavily subsidized by the state). If you’re starting that early, the growth on the money could make it worth it though.

Personally, we plan on matching our kids with whatever they plan on doing, when they plan on doing it and finding a way to make it work without debt. I can’t tell the future, but I do know there are so many ways to make a good living without college. I do know many people who are financially savvy and do have 529 plans, so there is something to it for sure. Good luck with your decision!