Inside: Streamline and simplify your budget with these minimalist budgeting tips. Because when you declutter your budget, you’re far more likely to track your spending, which can drastically reduce your money stress and help you reach your financial goals.

It was the end of the month: time to pay the bills and face the financial music.

Aaaaand, it was worse than I thought. We had overspent our income – again.

How did this happen? How were we still a couple hundred dollars short?!

I realized that in the stress of the past several months, I’d stopped closely tracking our spending because it felt like too much on top of everything else. It didn’t help that our budget was a cluttered mess.

I’d let myself slide into that blissful, but naive “maybe if I ignore it and believe all the numbers will sort themselves out, it will all be fine” mentality. And I’d grossly underestimated how much we were spending.

I naively assumed that we were hitting the numbers in our budget categories without any tracking or effort.

Yeah…nope.

Our budget needed a major decluttering overhaul. It was time to apply some minimalist principles to money management and get us back on track.

(And no, I’m not going to tell you to cut up your credit cards or stop getting coffee out. For thoughts on income problems, skip to the end.)

Minimalist Budgeting Tips to Declutter & Simplify Money Management

This post probably contains affiliate links, which means I may earn a commission if you make a purchase through those links. As an Amazon Associate, I earn from qualifying purchases. You can find our full disclosure HERE.

As much as ignoring your money can make you feel better temporarily, it almost always leads to massive anxiety when it comes time to pay the bills.

Plus a heaping dose of guilt and shame because you feel like you should be on top of your money, and you most definitely are NOT.

Like a cluttered home, a cluttered budget can cause unnecessary stress and overwhelm.

What’s the solution? Declutter the heck out of your budget and create simple systems to organize what remains.

Here’s how to create a minimalist budget.

You Might Also Like: A Flexible Minimalist Cleaning Routine (Essential Tasks Only)

1. Know what you’re actually spending.

You can’t create a realistic budget unless you know what you’re actually spending. So rip off the bandaid and spend a month closely tracking every purchase.

You might think you’re spending less than $1500 a month on groceries, but really, you’re currently spending more like $1700.

You might think $200 a month is enough for gas. But hello: have you SEEN gas prices lately?!

Or maybe you spend way too much money on plants every month (guilty).

Before you set budget categories and amounts, you need to have actual data. So take a deep breath, be brave and spend a month closely tracking your money.

If you already know your numbers, decluttering and simplifying your budgeting process will make you far more likely to keep track of all your dollars and stick to your money plan (which is really all a budget is).

Once you have real numbers, you can group your money into categories.

2. Keep your budget categories broad.

I used to divide things up into these itty bitty budgeting categories: my coffee budget, me and my husband’s “other allowance” budget, kids’ clothes, educational expenses, eating out, groceries.

I could go on and on.

Faced with these tiny categories, actually putting purchases into our budget tracking app was a royal pain in the butt.

I had to search for the correct category, decide if a purchase counted as this or that, split purchases between categories…so much unnecessary clutter!

Decluttering categories and combining them into broader categories makes me want to track our spending because it’s so.much.easier.

Instead of separating groceries and eating out and coffee, it’s all one category.

Kids’ clothing and education and occasional allowance from paid jobs are now one category. My husband’s and I’s “allowance” (including clothes) is one category.

All annual expenses like Amazon Prime and medication? One category.

Stick to broad categories to make tracking spending – an essential part of budgeting – simpler, which means it’s far more likely that you’ll actually do it.

You Might Also Like: 5 Easy Steps to a Minimalist Pantry (Save Time, Money, and Stress)

3. Find a simple budget tracking tool.

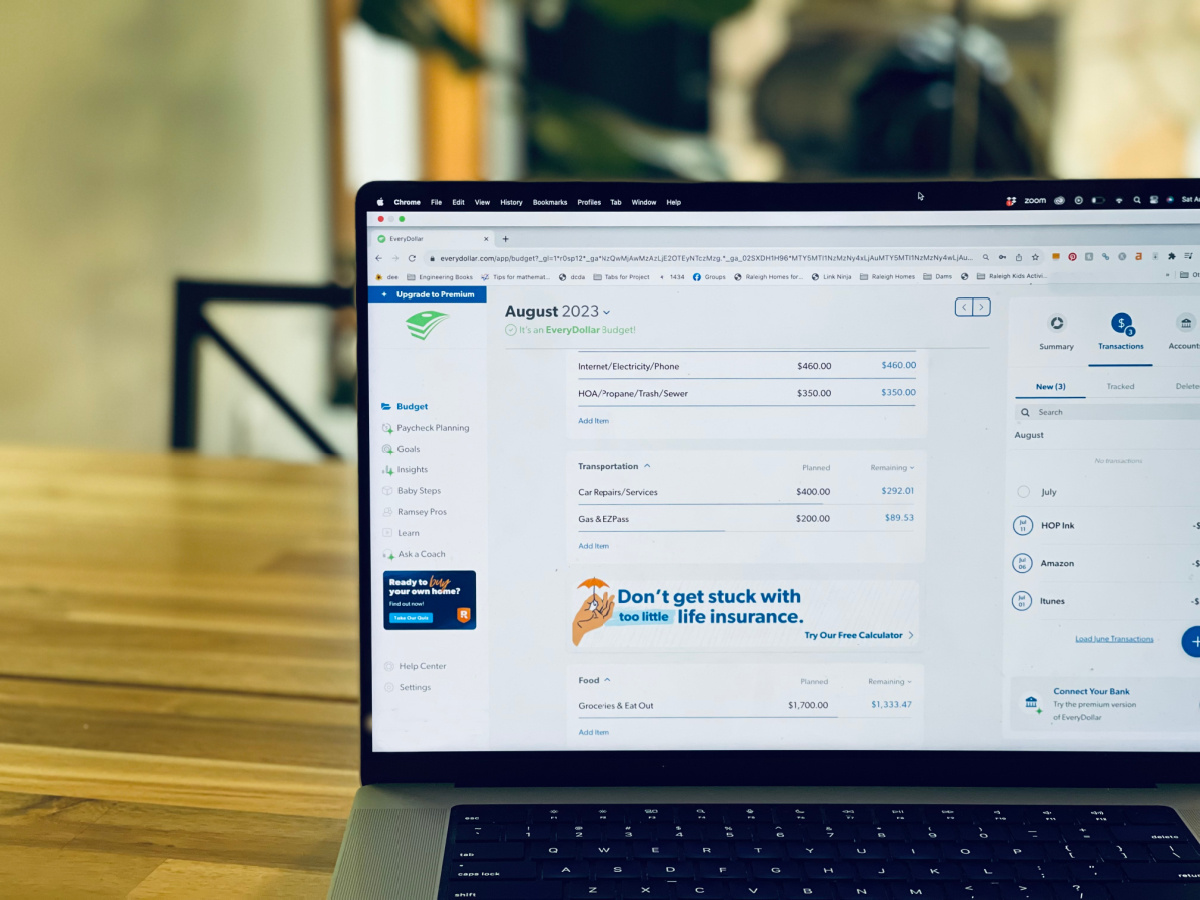

As much as Dave Ramsey is not my favorite person for financial advice, Every Dollar is still my go-to app for budgeting and tracking our spending because I haven’t found anything similar that’s also free.

You can name and set the categories. You can easily copy over one month’s budget to the next.

It will show you exactly how much is remaining in each category and for the month.

Going over your budget in a category will show up as negative, red numbers, so you can easily tell at a glance when you’re out of money in a category.

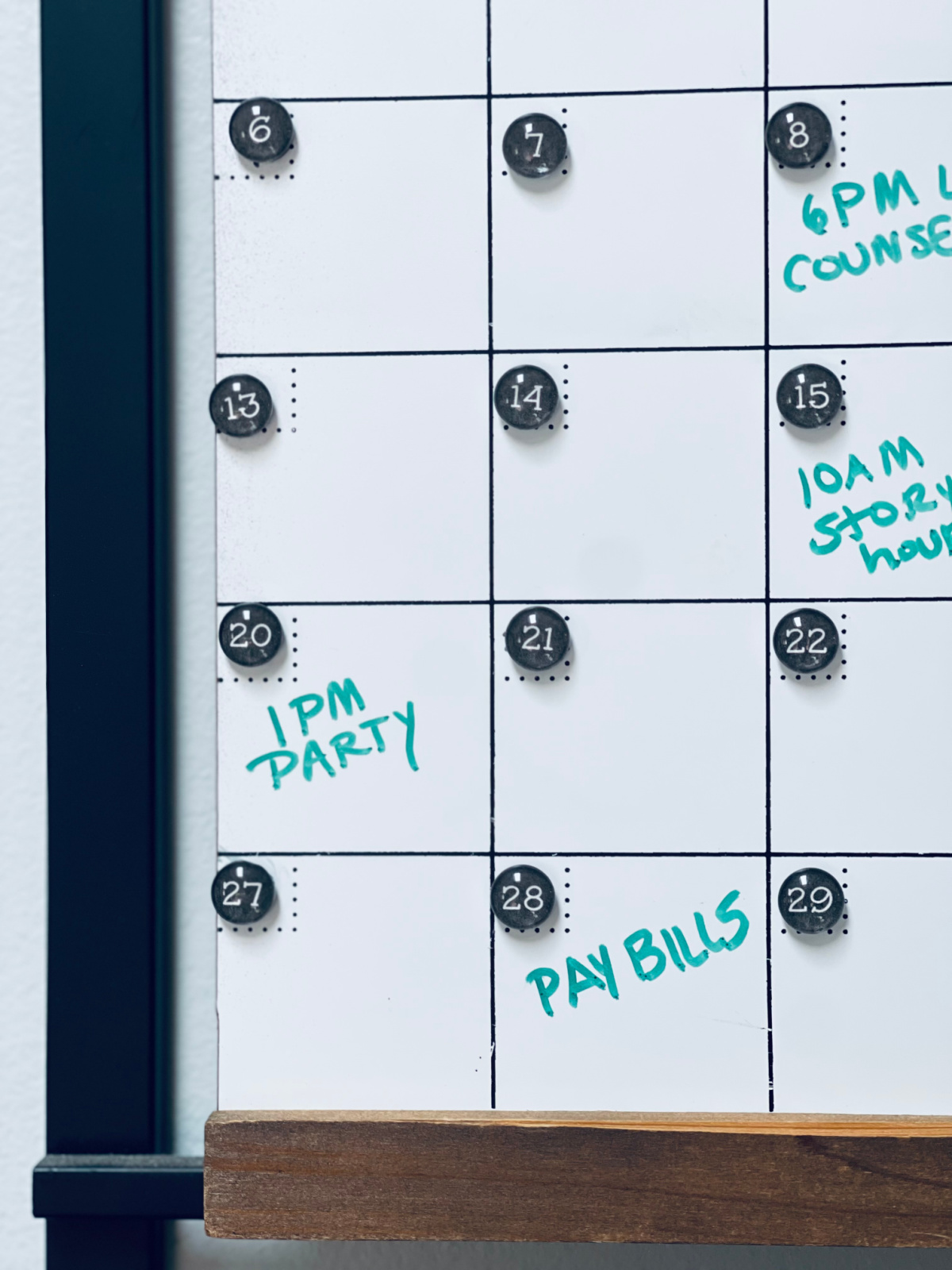

4. Decide in advance when you’re going to enter your spending into your budgeting app.

Because I’m the one that does the majority of the spending in our household, I try to enter all spending into our budgeting app right away.

But your household might be much more evenly divided in your spending.

If that’s you, you might need to sit down at the end of the day and check your bank account and credit cards. Or you might choose to track once a week.

Either track daily or weekly. Don’t wait longer than that, or it will take too long AND you will likely overspend and not realize it until too late.

Whatever you decide, establish a routine and make it a habit.

If you’re married and you’re the one who manages the finances, make sure to update your partner on the budget at a set time each week, as well.

(I also have a set time of the month to pay all the bills that aren’t set to automatic payment – credit cards and our mortgage.)

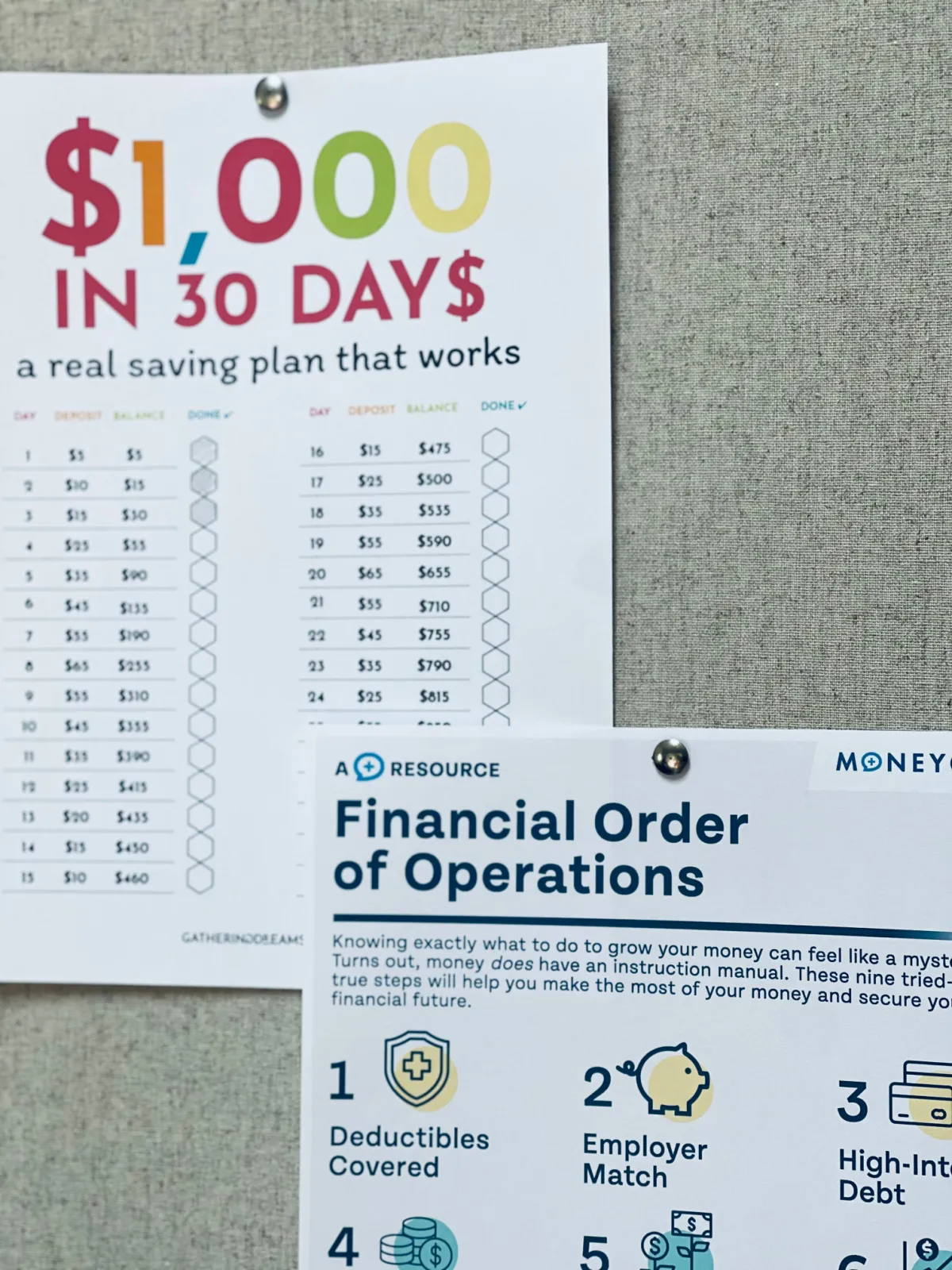

5. Set up sinking funds for future and recurring annual expenses.

I love, love LOVE my sinking funds, which are basically fee-free savings accounts.

I have sinking funds for:

- Car Repairs

- Christmas

- Annual One-Time Expenses (Propane Pre-Buy, HOA dues, Amazon Prime etc.)

- Vacations

Part of our monthly budget is set aside for each of these categories.

Now that I’ve gotten our spending under control and know exactly how much we have, I transfer funds for these categories into their respective funds at the beginning of the month.

I keep our sinking funds as separate, simple savings accounts with Capital One. I’ve also heard good things about Ally.

Knowing the money is going to be there when we need it for things like our annual Dropbox fee, our Propane pre-buy or our annual low-key beach trip is a game-changer.

Related: A Realistic Christmas Budget – 7 Things You’re Forgetting to Include

6. To make saving easier, “hide” as much money from yourself as you can.

Anything you can have removed from a paycheck in advance and sent to retirement or savings, do it!

Most HR departments offer this type of automatic deduction.

We are thankfully in a season of life when we can set aside a good portion of my husband’s paycheck for retirement.

My income fluctuates from year to year, so I “hide money” by keeping my earnings in a business checking account with a significant buffer. I transfer the same amount of money each month into our personal checking account, a number well below my earnings.

At the end of the year, any leftover money can then be added to long-term savings goals like my roth IRA, a second car or increasing our emergency savings account to my target amount.

7. Snowball debt pay-off and savings goals.

Again, not a Dave Ramsey fan, but paying off one debt at a time is a genuinely genius idea. We used his “debt snowball method” to pay off our student loans.

(Only caveat: if I could go back, I would focus on the debt with the highest interest rate first, instead of the smallest amount.)

Now apply the same “snowball” method to your savings goals.

For example, maybe you need to establish a baby emergency fund of $2,000, but you also know you’ll need to buy a new-to-you car a few years from now.

If you have $400 a month to save towards something, instead of dividing it up between the two goals, focus on the higher priority goal FIRST.

Put all $400 towards your emergency fund, for example. Once it hits your $2,000 goal, shift that $400 towards your car goal.

Seeing those numbers go up faster towards a single goal is so much more satisfying, and can give you the psychological boost of hitting a big goal sooner, which will keep you going with the next big savings goal.

You Might Also Like: We Happily Bought a 14-Year-Old Used Car – Here’s Why

8. Write a happiness list to eliminate impulse buys and get the most joy out of your non-essential spending.

If you’re a regular reader, I probably sound like a broken record, but I’m gonna keep on saying it:

You need to write a “happiness list”. These are the things in life that bring you the MOST joy.

Your spending obviously needs to all add up to equal or less than your income, but your spending should bring you joy!

Here’s part of my happiness list, in order of priority…

- Coffee

- Running/Walking

- Savings (Stability/Security reduces my anxiety)

- Quality Skincare

- Reading

- Plants

That means that spending money on things like new running shoes, our savings account and a weekly Starbucks beverage is a higher priority for me than buying another plant (as much as I love my plants).

I might still buy a plant one month, but only if there’s extra “allowance” money leftover.

It also means I don’t care about things like having a lot of shoes or jewelry or fancy bags, so I can easily skip impulse buys that aren’t worth it for me personally.

This list will help keep your non-essential spending on track, making sure your purchases are bringing you joy.

I do find creative ways to make some of these things happen for free, like shifting any Amazon purchases to a different shipping day in order to earn digital credit for ebooks.

Or always shopping with the Honey extension on my laptop to earn free money.

9. Take advantage of credit card benefits IF you can use them responsibly.

Credit cards offer SO many benefits for anyone able to use them responsibly.

Using credit cards responsibly means not overspending and paying them off IN FULL every month. If you can’t do that, forget I even said anything.

If you can, read on.

Credit card rewards are basically offering you free money. I’ve been using them for almost a decade to clothe my family for FREE (yes – FREE).

If you don’t need new clothes constantly like our family does, but you love to travel, you could have a travel credit card. Or a card that offers more cash back on groceries and eating out.

Look at your happiness list and get a card that makes sense for your unique lifestyle.

Using a credit card also makes it super easy to track all your purchases compared to using cash.

They also offer a lot more protection than banks do on debit card purchases, which I learned the hard way during a very horrific AT&T billing error where they misapplied my debit card to another account and took hundreds out of my bank account for two months before I caught it!

Related: My Secret to Getting Brand New Clothes for FREE ($1000 a year or more)

10. Make smart, painless budget cuts whenever you can.

I grew up in a household where my parents were both teachers. That means my mom was constantly trying to cut costs.

Once, she attempted to substitute powdered milk for real milk. YUCK. Talk about painfully frugal!

I still like saving money…just in far less painful ways. Here are a few ideas:

- Monitor your subscriptions every few months: do you really use all those streaming services? What about apps with monthly or annual charges?

- Are you using paperless billing for all your bills? Many companies give you a $5 a month discount – that’s $60 a year saved with one click.

- Can you switch electricity or internet providers?

- Could you borrow half your books from the library, instead of buying 5-6 a month?

- Does Mint Mobile work in your area (I believe they use T-Mobile towers)? Their plans are super cheap!

These are just a few ideas for cutting costs in ways that are relatively painless.

Sometimes you have to make more drastic cuts, but if you can, start with the financial clutter you’ll never miss.

You Might Also Like: What We Spend Per Week on Groceries as a Family of 7 (in 2024)

11. Build in a buffer category for unexpected expenses.

No matter how well you plan, there are always those pesky, unexpected expenses.

Like when there were Canadian wildfires, and we had to buy an $150 air purifier on the spot. Or when my cell phone broke, and I needed to cover the insurance deductible.

You could take those out of your emergency fund. But it’s really better to save that fund for true emergencies like medical crises, major home repairs, natural disasters or unemployment.

And there will always be unexpected expenses, so plan for them.

So for smaller unexpected expenses (less than $200 or $300), try to build in a buffer section of your budget.

Favorite Personal Finance Books and Podcasts (Minimalist & Non-Minimalist)

Here are a few of the personal finance books and podcasts that have guided our financial steps over the past three years.

You Might Also Like: 17 Life-Changing Non-Fiction Books (on Minimalism, Finances and More)

The Year of Less by Cait Flanders

The Year of Less documents the author’s decision to go on a year long spending freeze in order to cut back on non-essential spending and learn how to live with less.

This book is so inspiring, but also very honest about the emotional ups and downs of cutting your spending. I love this honest memoir of one person’s minimalist journey.

Playing with FIRE by Scott Reickens

THIS book was my first introduction to the FIRE movement (Financial Independence – Retire Early) and the idea of a happiness list!

Retiring early isn’t for everyone, but I would encourage anyone to consider the financial independence part.

When we finally started having some extra money to throw at investing and savings, I knew exactly what to do with it because of books like this one.

The Simple Path to Wealth by J.L. Collins

Another book highly recommended by the FIRE movement, Collins outlines exactly where to put your investments in order to avoid costly fees and financial advisors.

I followed his advice when I opened my Roth IRA last year, and will do the same when we open one for my husband eventually.

If you want to DIY your investments, this is the book for you! His latest book Pathfinders looks great, too.

The Money Guy Show

These guys offer great overall financial advice on their blog and podcast. I love their easy to follow steps for saving money and growing investments for retirement.

Their podcast has SO much information! From reader questions to stand-alone episodes on all things personal finance.

(Just keep in mind, their audience has a bit more

Jessi Fearon

While I don’t agree with everything Jessi recommends (she follows Dave Ramsey’s advice to the letter, which includes having no credit cards), she is GREAT at helping people budget and cut costs.

Her family paid off thousands of consumer debt on a small income, and they continue to achieve impressive financial goals on a modest income.

Her blog is a wealth of inspiration, frugal living tips and budgeting information. She also published a book called Getting Good with Money, putting all her advice in one place.

When Minimalism and Budgeting Just Aren’t Enough (a.k.a. You Have an Income Problem)

Several years ago, a few of the tips in this article would have helped me. God knows all those free clothes from credit card rewards certainly did.

But really, we were living paycheck to paycheck. There wasn’t enough money to manage.

Back then, we didn’t have a budgeting problem. We had an income problem.

Because we had an income problem, I kind of resented minimalists at first. They would talk about investing in higher quality products that would last longer…when all I could afford were the $20 shoes from Target (on clearance).

Eventually, when I realized my kids were not going to school anytime soon because we chose to homeschool, I knew we had to do something about the income problem.

I started an online business – this blog. It took two years for it to see a real difference, but it has forever changed our financial story.

Fast forward seven years later, and we now have money to save for retirement more aggressively, have a decent emergency fund and save up for a second vehicle as our kids approach driving age (we’ve been a one car family for almost 16 years).

Can you start a business from home? Work a side hustle ten hours a week outside the home?

Anything to give you more financial margin, which will make budgeting a more enjoyable process.

Will it take hard work and sacrifice? Yes. But as a former extreme couponer, I desperately wish I’d put all those hours I spent trying to cut costs into increasing my income sooner.

Because honestly, budgeting isn’t very fun at all when you’re pinching pennies and treading water financially.

Read Next: 9 Flexible Work at Home Jobs for Homeschool Moms

I hope these minimalist budgeting tips take the stress out of managing your money. Have more tips? Share in the comments!

Love these posts can all use money saving tips. We are on a budget too. Like the happiness list. That’s a good idea from impulse buying.